The death of 'risk on/risk off'?

The last few years has reminded us that investing comes with risk. While it is scary and difficult after a long tough period, we need to recognise that successful investing is ultimately about using opportunities to generate returns. In this regard I am endlessly amazed at the capacity of many to see disaster around the corner of everything.

Some commentators have given up on an immediate return to the GFC (the fabled ‘double dip’) and are now simply saying that the global economic recovery and rebound in share markets are simply setting us up for the next disaster. Given markets always go in cycles this is a bit like saying "I didn't expect the sun to rise today, but it doesn't make any difference because it will only set again this evening" and so the darkness will return.

Another example is Japan. For decades it has been chastised for its lack of action in dealing with its slump. Now that Japan’s policy makers are finally doing something, many are now worrying its actions will simply cause another crisis.

Another concern is the phenomenon of ‘risk on/risk off’, which is the topic of this note. Since the GFC, listed growth assets such as shares, commodities and the Australian dollar have been moving pretty much together, and inversely to government bonds in so called ‘safe’ countries. In recent times this simple relationship seems to break down. And yet again many fear it is a bad sign. Or is it really just a sign that things are returning to normal?

Risk on/risk off - what is it?

Since around the time of the GFC listed growth assets like shares, corporate debt, commodity prices and the Australian dollar have all been moving closely together but inversely versus assets like government bonds in so-called ‘safe’ countries and the US dollar and the yen.

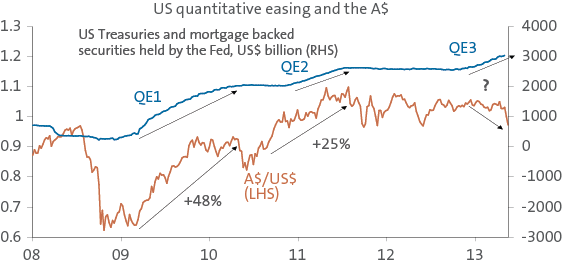

In other words, when investor confidence was on the mend the ‘risk on’ assets (shares, corporate debt, commodities and the Australian dollar) would rise whereas the ‘risk off’ assets (government bonds in ‘safe’ countries, the US dollar and the yen) would sell off. This was evident when the several rounds of quantitative easing (QE1 and QE2) were undertaken in the US. The opposite would occur when confidence slumped. As a result investment markets simply rotated between periods of ‘risk off’ and periods of ‘risk on’.

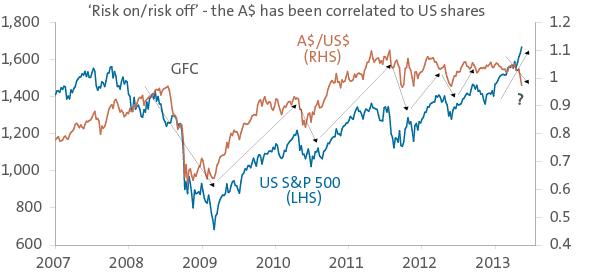

This can be seen in the next chart showing the relationship between the A$/US$ exchange rate and the US share market.

Source: Bloomberg, AMP Capital

As a result the correlation (or the extent to which they move together) between the ‘risk on’ assets was very high. It basically reflected the macro-forces – emanating largely from the US and Europe over the last few years – that have dominated other more asset specific influences. This has come to be known as ‘risk on/risk off’. It meant that macro-forces have dominated everything, whereas industry or asset specific developments were subsumed.

Risk on/risk off breaks down

Recently though ‘risk on/risk off’ has shown signs of breaking down. This has become particularly evident since the commencement of the latest round of quantitative easing (QE3) in the US. Whereas the first two rounds in 2009-2010 and 2010-2011 saw rallies in all ‘risk on’ assets, the latest round (QE3) has been messier with equities and corporate debt rallying and the yen selling off, commodity prices falling, the Australian dollar falling and bond yields being range bound. This is evident in the next chart which shows the relationship between the US Federal Reserve’s (Fed) holdings of US Treasuries and mortgage backed securities as a guide to quantitative easing and the value of the Australian dollar. The break down between US shares and the Australian dollar is also seen in the previous chart.

Source: Bloomberg, AMP Capital

Some interpret this as a bad sign: that the fall in commodity prices and the Australian dollar and the failure of bond yields to rise much beyond their recent ranges is an indication that all is not well with global growth. In other words, shares have got it wrong.

However, there is a more benign, and in fact, positive interpretation and this is that the breakdown of the ‘risk on/risk off’ relationship reflects a weakening of debilitating macroeconomic threats. Specifically:

- The risks around a break up in the euro are continuing to decline and this is reflected in an ongoing slide in bond yields in troubled Eurozone countries. Italian and Spanish bond yields have now fallen back to where they were in 2010. Two year bond yields are now 1.3% in Italy and 1.7% in Spain. Greek 10 year bond yields have fallen back to 7.95% from a high last year of 37%.

Source: Bloomberg, AMP Capital

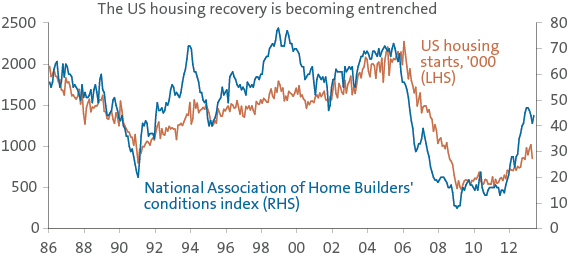

- While public debt problems continue in the US the budget deficit is at least falling faster than expected (now running around 5.5% of gross domestic product (GDP), down from a peak of over 10% and set to fall to 4% of GDP in 2014) and the private sector is looking a lot healthier with consumer sentiment at its highest in almost six years, a recovery in housing activity set to contribute 1% or so to growth this year and capital spending looking stronger.

Source: Bloomberg, AMP Capital

- Japan is looking a lot stronger with growth rebounding in the March quarter and set to strengthen further as the massive monetary easing from the Bank of Japan, the sharp fall in the value of the yen and fiscal stimulus start to impact. While some fret that a back up in Japanese 10 year bond yields from below 0.5% in early April to around 0.97% is a concern, I think it is a positive sign in that even bond investors are starting to think that there is a chance that Abenomics (the policies introduced by new Prime Minister Abe) will work and hence are starting to believe that inflation may rise to the targeted 2% level in a few years time. Japan is the world’s third largest economy so its resurgence is a very good sign.

- Finally, Chinese growth seems to be settling around 7.5% with less concern about a hard landing, although the weak HSBC manufacturing conditions index (PMI) for May suggests that growth still faces some downside risks.

It should also be stressed that the ‘risk on/risk off’ phenomenon was not normal. Rather it was a phenomenon of the GFC and the post-GFC period where macroeconomic threats were so immense that they drove all listed growth assets to move together. The correlation between the Australian dollar and US shares and between commodities and US shares was a lot lower prior to the GFC.

Now that we are just going back to something a bit closer to normality, the reduction in macroeconomic threats has meant that individual asset classes are being driven more by their own fundamentals. In this regard:

- Share markets have benefitted from reduced risks regarding global growth, a pick up in cyclical sectors like consumer stocks and a surge in high yield stocks as investors seek out better yields than bonds and bank deposits. By contrast material stocks have been held back by commodity worries.

- Commodity prices are reacting to more negative supply and demand fundamentals - the supply of commodities is picking up after a world wide mining investment boom and this is occurring at a time when it increasingly looks like Chinese growth is settling around 7.5% down from over 10% over the last decade.

- The Australian dollar is reacting (at last) to the commodity price downtrend along with interest rate cuts from the Reserve Bank of Australia which are reducing the attractiveness of parking money in Australia at a time when the US is starting to look more attractive. More downside in the Australian dollar is likely.

- Bond yields have remained low as it is become clear that interest rates are going to stay down for longer, particularly as inflation continues to surprise on the downside. In the US inflation is now just 1.1%, in Europe its 1.2%, in Canada its 0.4% and its now falling in the UK.

In other words, individual assets have gone back to better reflecting their fundamental drivers. This is healthy.

What does this mean for investors?

None of this is to say that macroeconomic risk has gone away. Problems still remain and it will be a continuing source of volatility, as for example gyrations around when the Fed will start to reduce its monetary stimulus attest. However, its influence is fading, leading to a breakdown in the ‘risk on/risk off’ correlations we have seen since around the time of the GFC. For investors this has several implications:

Firstly, it is good news to the extent it signals the world is starting to return to normal after the mess of the past few years.

Second, macroeconomic factors will remain critically important for investors to monitor, but perhaps not as overwhelming as they have been.

This means that individual assets will start to better reflect their own fundamentals. This is already evident in the weak trend in commodity prices and the Australia dollar versus the strong trend in share markets. It is also evident in the divergence in cyclical sectors in share markets. For example, consumer stocks are up over the last year, but material stocks are struggling.

This in turn means that the benefits of having a well diversified portfolio, whether in terms of holding individual shares, across global share markets or in growth assets, should be more evident in the years ahead.

We would like to thank Dr Shane Oliver Head of Investment Strategy and Chief Economist AMP Capital for this article